KONDA Biopsy report

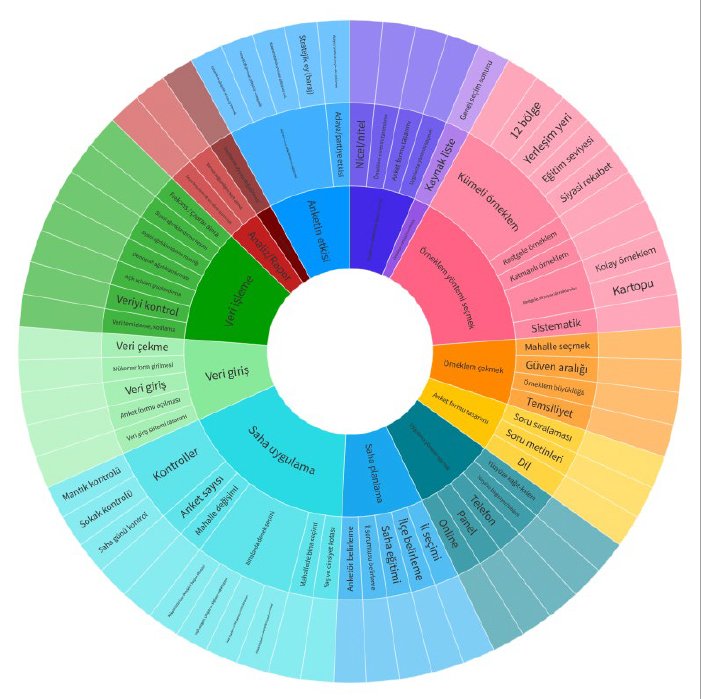

In the run-up to the general elections, we have subjected the poll results we announced on May 11th to a comprehensive examination of the inaccuracy of the results beyond the margin of error. We called this process BIOPSY. In this study, we questioned everything from method selection to sample design, from field methods to weighting methods.

December 2023biopsy May 14 Elections

Home Care and Time Use During the Pandemic

The content of the report reflects the opinions and preferences of the people interviewed. Face-toface interviews were carried out in households of select regions during the period 22-24 October 2021. The findings on pandemic practices and time use were compared with the findings of similar research we carried out in May 2020 and April 2018. In this way, we tried to understand the changing practices of society before the pandemic, during the pandemic restrictions and after the pandemic restrictions.

April 2022pandemic homa care time use barometer

KONDA Media Report

The Life-Styles Survey is the most-debated, most commonly referenced survey of KONDA, both in the press and in academia. The survey was modelled on perceptions, fears, expectations, political preferences, values, demographic characteristics and daily life-practices.

January 2020media report KONDA

Ballot Box Analysis of The 23 June Istanbul Election and Voter Profiles

We are sharing this report with the public following the re-run of the Istanbul Metropolitan Mayoral election. It consists of two main parts and in the first part, “ballotbox analysis”, the results of the June 23rd election is compared, at the neighborhood and district levels, with those of March 31st Local Elections and June 24th 2018 General Elections. Besides the actual outcome, the “political profiles” part is based on three field surveys representative of Istanbul and allows you to examine how candidate preferences have changed in various social clusters.

June 2019Election barometer

Polarization in Turkey

This report on the theme of ‘Polarization in Turkey’ was part of the Konda January’19 Barometer survey and is shared with the public within the legal framework of the contract we have with our subscribers.

January 2019Polarization Syrian Refugees Rights of Religious People Gender barometer

Populist Behavior, Negative Identification and Conspiracism

This report on the theme of ‘Populist Behavior, Negative Identification and Conspiracism’ was part of the Konda November’18 Barometer survey and is shared with the public within the legal framework of the contract we have with our subscribers.

November 2018Behavior Identification barometer

Individualism in Turkey

This report on the theme of ‘Individualism in Turkey’ was part of the Konda October’18 Barometer survey and is shared with the public within the legal framework of the contract we have with our subscribers.

October 2018Individualism collectivism barometer

Economic Crisis Perception

This report on the theme of ‘Economic Crisis Perception ’ was part of the Konda September’18 Barometer survey and is shared with the public within the legal framework of the contract we have with our subscribers.

September 2018economic debt condition barometer

Analysis of the Results of the June 24th Election and the Electorate

This report comprises of the section on ballot box analyses from the July’18 Barometer report that KONDA Research and Consultancy shares with its clients as part of its Political and Social Research Series.

September 2018Election barometer

Social Mood

This report on the theme of ‘Social Mood ’ was part of the Konda July’18 Barometer survey and is shared with the public within the legal framework of the contract we have with our subscribers.

July 2018depression safety happiness barometer

Musical Preferences and Means of Communication

This report on the theme of ‘Musical Preferences and Means of Communication’ was part of the Konda April’18 Barometer survey and is shared with the public within the legal framework of the contract we have with our subscribers.

April 2018music barometer

Time Use

This report on the theme of ‘Time Use’ was part of the Konda July’17 Barometer survey and is shared with the public within the legal framework of the contract we have with our subscribers.

July 2017time use barometer